Content

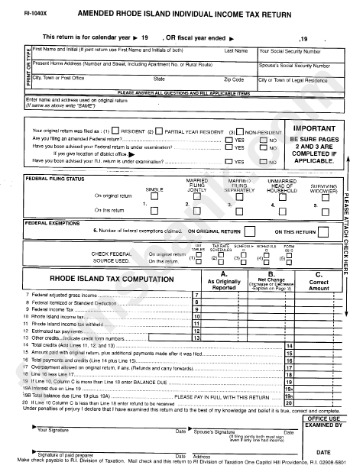

However, you should know that not all of your income is taxed at that rate. For example, if you fall in the 22% tax bracket, not all of your income is taxed at 22%. The reason is that the U.S. income tax system uses a graduated tax system, designed so that individual taxpayers pay an increasing rate as their income rises as outlined in the 2022 tax brackets above. The term tax table refers to a chart that displays the amount of tax due based on income received. Tax tables are provided by the Internal Revenue Service to help taxpayers determine how much tax they owe and how to calculate it when they file their annual tax returns. The IRS provides different tax ranges in the tax table by tax filing status.

Is the UK the most taxed country in the world?

According to data from PricewaterhouseCoopers, income tax rates for the highest earners are relatively low in the UK compared to other European OECD nations. Again, Denmark has the highest personal income tax rate, at 56%, compared to 45% in the UK.

Personal state programs are $39.95 each (state e-file available for $19.95). Most personal state programs available in January; release dates vary by state. H&R Block Free Online is for simple returns only. Description of benefits and details at hrblock.com/guarantees. Social Security and Medicare taxes fall under the Federal Insurance Contributions Act taxes. When you want to know the FICA tax rate, you should refer to the two categories below.

Subscribe to Kiplinger’s Personal Finance

UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb. Given that Congress has prescribed a system of progressive taxation, all but the lowest-earning taxpayers pay distinct rates for different parts of their income. The IRS started accepting taxpayers’ returns for this year’s tax season back in January. Most Americans have until April 18 to file, though they can request a six-month extension to Oct. 16. 100% Accurate Calculations Guarantee – Business Returns. If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we’ll pay you the penalty and interest.

“The flip side of this, though, is that it’s going to be harder to itemize your Irs Tax Rate Schedules s in 2023,” Steffen said. “That means your tax payments, mortgage interest and charitable contributions are less likely to provide you a tax benefit next year.” The IRS tax tables provide estimates for income under $100,000 and a worksheet for incomes above that. Of course, our software will always automatically calculate the exact liability so estimating is not required.

Headline rates for WWTS territories

But that’s not the only way to describe Sarah’s taxes. We could also talk about her average tax rate and marginal tax rate. As specified in the tax code, an individual income tax is imposed on the wages, salaries, investments, and other forms of income that people earn. The tax code indicates both how to measure income subject to taxation and the tax rates that apply to that income. The modified adjusted gross income amount used by joint filers to determine the reduction in the Lifetime Learning Credit provided in § 25A is not adjusted for inflation for taxable years beginning after December 31, 2020.

What is the highest tax return?

New for 2021

The new numbers are: Married couples filing jointly: $25,100. Singles and married couples filing separately: $12,550. Heads of households: $18,800.

We cannot https://intuit-payroll.org/ the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool. The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide.

if (d.getElementById(id)) return;

He has also been quoted as an expert by USA Today, Forbes, U.S. News & World Report, Reuters, Accounting Today, and other media outlets. Rocky has a law degree from the University of Connecticut and a B.A. So, that’s something to keep in mind when you are filing a return or planning to reduce a future tax bill. Bankrate follows a stricteditorial policy, so you can trust that our content is honest and accurate. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Our experts have been helping you master your money for over four decades.

- Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site.

- Social Security and Medicare taxes fall under the Federal Insurance Contributions Act taxes.

- In the U.S. tax system, income tax rates are graduated, so you pay different rates on different amounts of taxable income.

- Rocky was a Senior Tax Editor for Kiplinger from October 2018 to January 2023.

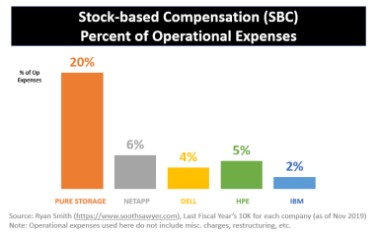

Tax tables are commonly used by individual and corporate taxpayers with modest income levels. High-income earners tend to use more detailed tax rate schedules in conjunction with itemized deductions.

This is how graduated tax rates work; they apply to all filers. The tax rate you pay varies according to your filing status and income. Those behavioral responses would be more pronounced if larger increases in individual income taxes were implemented. As a result, the deficit effects of large rate increases or surtaxes might not be proportional to the estimates shown here. Most tax credits are nonrefundable, meaning they are limited to the amount of taxes owed.

The third alternative—imposing a surtax of 1 percentage point on AGI above the personal exemption and standard deduction—would increase the amount of federal income taxes paid by almost all households. But compared with a 1 percentage-point increase in all tax rates on ordinary income, a tax on AGI would have a larger effect on the share of income paid in taxes by higher-income households. By creating a tax on AGI, a measure of income that has limited exclusions, the third alternative would increase the share of income paid in taxes by some higher-income households compared with the first alternative.